Addressing this issue has been a longstanding priority for the Indian government. Over recent years, numerous policies under the ‘Housing for All by 2022’ initiative have aimed to support residential construction, improve affordability and ultimately boost housing supply.

One key impediment for construction companies and developers has been a lack of financing options for purchasing land and funding early stage, pre-approval schemes.

In January 2016 and December 2017, ADIA completed investments in two funds: HDFC Capital Affordable Real Estate (H-CARE) 1 and 2. In total, the two funds form a $1 billion platform that aims to meet demand from developers for flexible funding, targeting both equity and debt opportunities in affordable and mid-market for-sale residential projects around India.

HDFC is one of the largest mortgage lenders in the country, with extensive relationships with leading development companies as well as in-house construction and project management expertise.

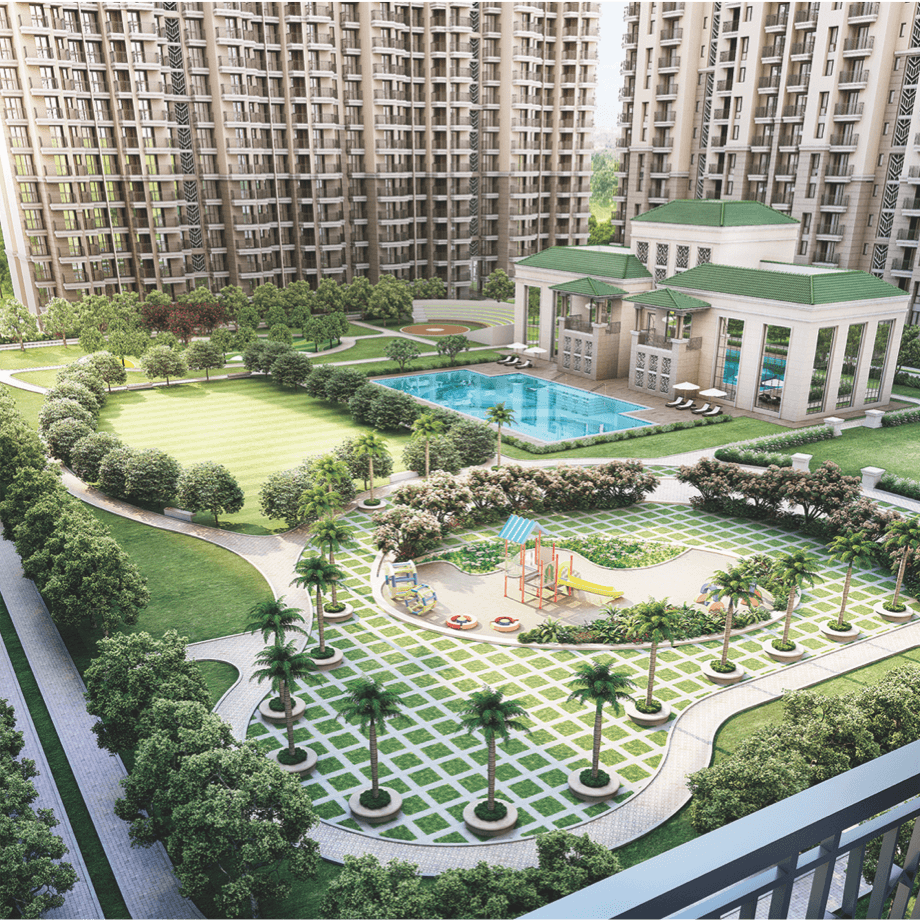

Since the H-CARE platforms were launched, they have supported the development of more than 56 residential projects and 122,000 units across five states in India, providing financing solutions to developers to meet their capital requirements.