2019 Review

Prudent Global Growth

Our Mission

ADIA’s mission is to sustain the long-term prosperity of Abu Dhabi by prudently growing capital through a disciplined investment process and committed people who reflect ADIA’s cultural values.

Letter from

Hamed bin Zayed Al Nahyan

The start of a new decade always brings opportunities for reflection, particularly when faced with an economic and investment landscape that has few precedents in history.

Read more2019 at a Glance

2019 Global Market Highlights

- Most equity indices surged by more than 20%, while bonds also delivered solid returns.

- Market strength was underpinned by widespread easing in monetary policy.

- Global growth remained weak, with lower industrial production balanced by strength in services and consumer spending.

- By late 2019, major economies began to show promising signs of recovery.

Key ADIA Developments During 2019

- Completed a major project to refine ADIA’s strategy model.

- Launched a new ADIA-Wide Planning process.

- Increased collaboration between departments at a strategic level to enable ADIA to capture investment opportunities that fall between asset classes.

- ADIA hosted an Africa Investment Summit to explore opportunities on the continent for long-term focused investors.

Long Term Market Outlook

- Covid-19 outbreak has caused a significant slow down in the global economy. Long-term implications remain unclear.

- The financial system is more robust than in 2008, and more able to withstand a global slowdown.

- China and India likely to remain key drivers of global growth over the long term.

- Climate change and ESG considerations to continue gaining prominence among investors.

- Advances in technology to bring fundamental changes to the investment industry over the next decade.

Operational Review

On the surface, 2019 bore all the hallmarks of a successful year. However, the strong market returns masked growing uncertainty as investors sought to navigate a complex assortment of fast moving events and longer-term paradigm shifts.

Read moreInvestment Review

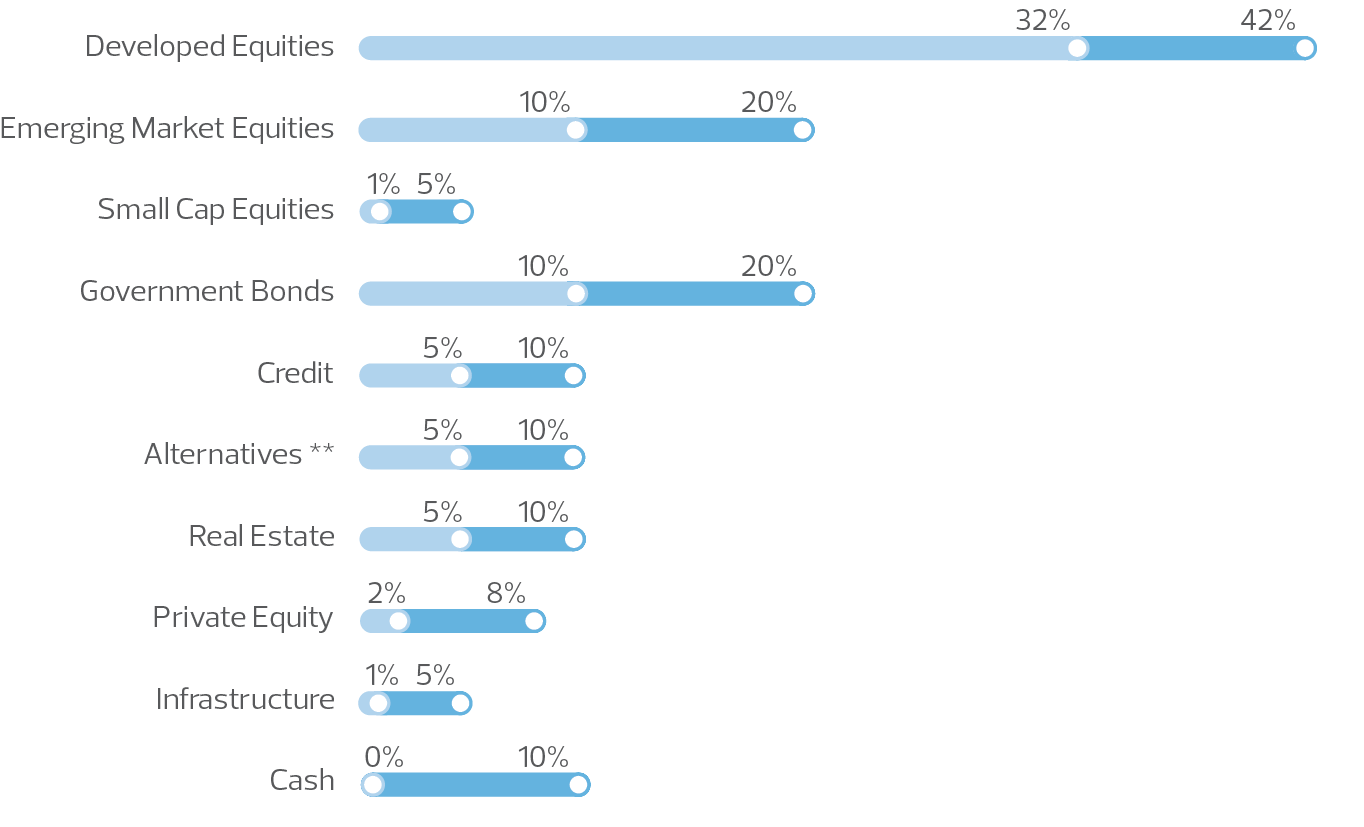

ADIA manages a global investment portfolio that is diversified across more than two dozen asset classes and sub-categories. ADIA’s investment departments are responsible for building and managing investment portfolios within the parameters set for them through the asset allocation process.

These investment departments, which invest across multiple geographies, have discretion over the origination and recommendation of investment proposals.

For more detail on each of ADIA’s major asset classes in 2019, please select the relevant section.

Equities

After a shaky 12 months in 2018, equity markets soared in 2019, helped by better-than-expected corporate earnings and accommodative monetary policy, among other factors.

read moreFixed Income

Fixed income markets delivered strong returns in 2019 as central banks around the world reversed plans to tighten monetary policy, bond yields fell and expectations for global growth declined.

read moreAlternatives

Financial markets remained buoyant throughout 2019, and this positive performance was reflected across alternative investment strategies. Most established managers enjoyed a strong year, often achieving double-digit returns, and many regained their high water marks.

read moreReal Estate

Global real estate markets remained resilient in 2019, marking a decade of uninterrupted growth. Consistent with its long-term focus, ADIA’s Real Estate Division continued to direct its activities in ways that seek to capture future growth trends.

read morePrivate Equity

The global private equity market remained active throughout 2019, with overall deal activity declining only slightly from the historic highs of 2018.

read moreInfrastructure

Strong global demand for infrastructure assets in 2019 was supported by sustained low interest rates and investors’ continued search for stable cash flows. The year was characterised by keen competition and elevated valuations for unlisted assets, strong fundraising activity, and an increased focus on attractive sub-sectors such as renewable energy and digital infrastructure.

read moregovernance

Board of Directors &

Investment Committee

Management of ADIA is vested in ADIA’s Board of Directors, which comprises a Chairman, Deputy Chairman, Managing Director and Board Members who are appointed by an Emiri decree of the Ruler of the Emirate of Abu Dhabi.

The Investment Committee assists the Managing Director and is responsible for managing and overseeing investment-related matters. The Managing Director chairs the Investment Committee, assisted by two Deputy Chairmen, with the participation of the Executive Directors of all investment departments and representatives of some control functions as required.

downloads

2019 Review

Download the full 2019 Review PDF. It contains the annual overview of all our activities and performance, including our Managing Director’s letter, Operational Review and more detailed breakdowns by asset class.

download PDF