Letter from

Hamed bin Zayed Al Nahyan

The start of a new decade always brings opportunities for reflection, particularly when faced with an economic and investment landscape that has few precedents in history.

As a long term investor, ADIA has an obligation to remain clear headed about the risks arising from imbalances in the financial system, while not allowing these to cloud our optimism over emerging innovations from technology and other advances in thinking.

For global markets, however, 2019 was not a year that was excessively burdened by reflection. Quite the contrary, as investors cast off the lingering concerns that had hampered returns a year earlier to ring in the new decade in buoyant fashion.

In what was a remarkable performance, given the complex backdrop, most equity indices surged by more than 20%, while bonds also delivered solid returns.

Unlike the equity rally in 2017, which was driven by a synchronised acceleration in global GDP, last year’s strength was underpinned by widespread easing in monetary policy. The US Federal Reserve’s decision in July to reverse course and start cutting rates quickly spread to other central banks, providing a fresh jolt of stimulus to markets.

The strong gains in 2019 were also partly a response to the sharp market sell-off in late 2018, which had been triggered by fears of a looming recession. As it turned out, those fears were exaggerated.

Real global GDP growth dropped from just above 4% in early 2018 to slightly below 3% at the end of 2019. However, this slowdown was caused mainly by a decline in industrial production, affecting mostly the automotive industry and trade, compounded by US-China trade tensions. While the global industrial powerhouses with a large share of trade-to-GDP were particularly impacted, economies that are more dependent on domestic consumption fared better.

As the year drew to a close, markets were further cheered by signs that economic stimulus was paying off, as major economies began to show promising signs of recovery.

The ‘tug-of-war’ between weak data on trade, as well as manufacturing and industrial activity on the one hand, and resilient data on services and consumer spending on the other hand, dominated global growth dynamics in 2019.

As it has done since its creation 43 years ago, ADIA continued in 2019 to deliver on its mission of prudently managing capital on behalf of the Government of Abu Dhabi. With a portfolio that is highly diversified, both across regions and asset classes, ADIA has successfully managed across market cycles to produce sustainable, long-term returns for the benefit of Abu Dhabi.

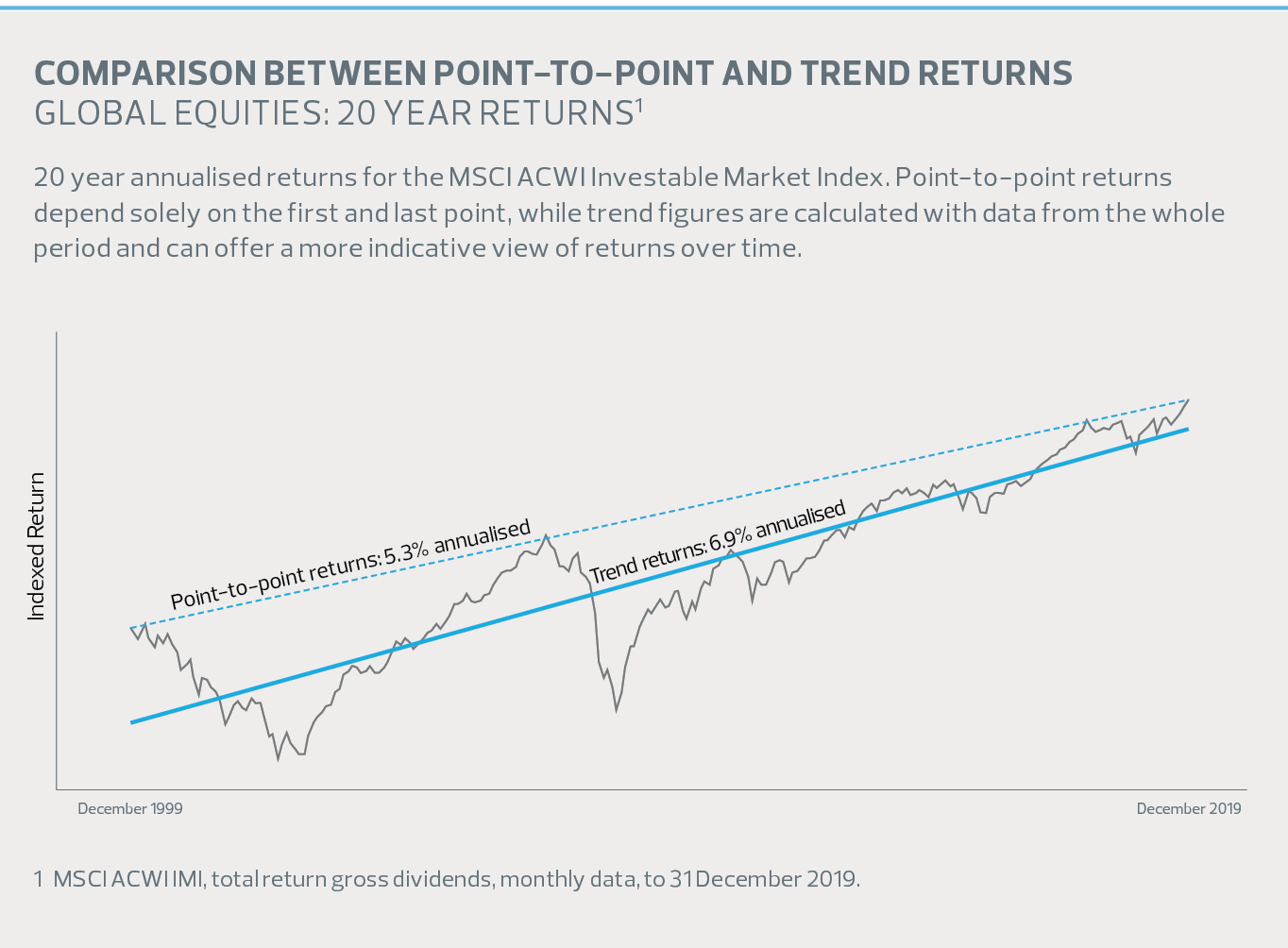

ADIA’s 20-year and 30-year annualized rates of return at 31 December 2019, on a point-to-point basis, were 4.8% and 6.6% respectively compared to 5.4% and 6.5% in 2018. The 20-year rate of return in particular was negatively impacted by the exclusion from the rolling average of strong gains in the late 1990s.

When looking back over the past decade, it is impossible to overstate the impact of, and subsequent response to, the global financial crisis of 2008-2009. The unprecedented stimulus provided by central banks revived global growth, reinforced the stability of our financial system and underpinned financial markets. Low inflation and interest rates have generated strong demand for financial assets, with listed corporations buying back their shares and liability-driven investors buying long-term debt instruments.

Private markets have also fared well, supported by a combination of robust earnings, low interest rates and higher equity market valuations. Real estate, private equity and infrastructure assets have benefited from important inflows, seeing their investor base broaden significantly. While they remain less liquid than public investments, investors now recognise that private markets offer complementary levers that can be used to build better-diversified and more resilient portfolios.

However, while the monetary policy response generated a rebound in overall growth and employment, it proved unable to generate much inflation outside of asset markets. With policy rates extremely low in several countries and regions, central banks have been left with limited scope for traditional monetary policy to assist in managing a global downturn.

Outlook

Financial and social systems are extremely difficult to forecast; all projections carry with them a wide range of assumptions and uncertainties and there is always a risk of external shocks. For this reason, we prefer to evaluate the spectrum of possible outcomes and build a portfolio that maximises our probability of reaching our objectives while remaining within agreed risk parameters.

Rather than trying to identify the exact timing of a downturn, our preference has always been to build resilience into our portfolio, while retaining the flexibility to capture opportunities that always arise when markets go through weaker periods.

What seems clear is that the years to come are likely to pose greater challenges for institutional investors than the decade that is ending. At the start of 2020, global markets fell sharply as it became clear that a coronavirus outbreak in China would become a global pandemic.

At the time of writing, the full implications of this unprecedented shock were still being assessed, but it already appears likely that the global economy will slow significantly, with a corresponding impact on investment returns.

More broadly, another risk remains a continuation of the trade tensions witnessed in 2019, spurred by both political and social pressures. Globalisation has been an important driver of the economic expansion of the past few decades, with financial markets and investors benefiting from the freedom of movement of goods, capital and people. However, the gains from global trade have not been shared equally between and within countries, which has led to growing social and political tensions across the globe.

It is likely that 2019 will be remembered as the tipping point when climate change and ESG considerations entered the mainstream. The momentum appears certain to continue, as evidence mounts of the attractive returns achievable through sustainable investing.

At ADIA, we view climate change as an opportunity. We already routinely incorporate climate change considerations into all of our investment proposals, and have been steadily expanding our exposure to renewable energy. ADIA’s Infrastructure Division, for instance, has invested in platforms that generate more than 15 gigawatts of renewable energy around the world. Through our involvement in the One Planet Sovereign Wealth Fund Working Group, we also play a continuing role in fostering a framework for sovereign wealth fund investments in sustainable assets.

On a geographic basis, we continue to see China and India as key drivers of global growth in the years to come, although we recognise the importance of remaining open-minded about possible new sources of return. With an abundance of natural resources and young, growing and increasingly educated populations, African countries are among those offering the greatest potential for long-term investors.

Of course, this comes with many challenges, which must be carefully weighed. However, we are monitoring developments closely and increasing our dialogue with potential local partners, with a view to accessing appropriate opportunities on the continent.

Looking ahead, advances in technology are likely to bring the greatest changes to the investment industry in the decade to come. The recent evolution in computational power has enabled machine learning techniques to tackle new problems of increased complexity, and this knowledge is now widely accessible through open source platforms. Investors are impacted by this technological revolution in multiple ways. Firstly, the companies they invest in are at risk of obsolescence if they do not adapt to this new reality. More directly, it is clear that investment processes themselves are being impacted. Well-designed systems can now process structured and unstructured financial information much more quickly and efficiently than any analyst, providing an unprecedented range of investment opportunities.

ADIA has made it a priority to integrate technology throughout our investment process, in ways that support our ability to generate insights and achieve superior returns. By enhancing our ability to process ever growing volumes of data, we are able to generate, test and implement new investment strategies with potential for higher marginal returns.

Finally, as in the past, I continue to have strong confidence in ADIA’s ability to adapt to, and benefit from, the opportunities and challenges that lie ahead. We will achieve this by building on our core strengths, while enhancing the agility needed to compete in an environment where opportunities evolve dynamically. It is through this combination of resilience and flexibility that we will continue to deliver successfully on our mission.