2018 Review

Prudent Global Growth

Our Mission

ADIA’s mission is to sustain the long-term prosperity of Abu Dhabi by prudently growing capital through a disciplined investment process and committed people who reflect ADIA’s cultural values.

Hamed bin Zayed Al Nahyan

Managing Director

With a long‑term mandate to generate returns for future generations, ADIA’s inherent preference is to view market performance in any given year within a broader context, to gain a more nuanced picture of overall trends. On this basis, 2018 provided ample reassurance despite challenging conditions.

Read the full letter

-

Portfolio

Portfolio overview

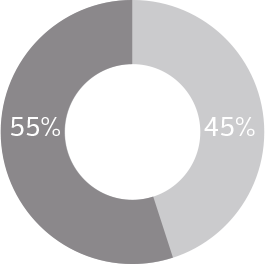

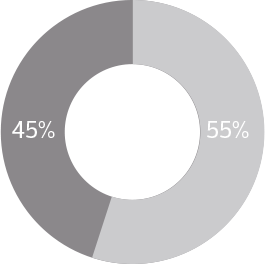

ACTIVE VERSUS PASSIVE MANAGEMENT ActivePassiveINTERNAL VERSUS EXTERNAL MANAGEMENT

ActivePassiveINTERNAL VERSUS EXTERNAL MANAGEMENT InternalExternal

InternalExternal- Minimum

- Maximum

-

Regions

Long-term policy portfolio by region

*ADIA, as a matter of practice, does not invest in the UAE.

Long-term policy portfolio by region

NORTH35% MIN

50% MAX

EUROPE20% MIN

35% MAX

EMERGING15% MIN

25% MAX

DEVELOPED10% MIN

20% MAX

*ADIA, as a matter of practice, does not invest in the UAE. -

Annualised Returns

Annualised rates of return

In U.S. Dollar terms, the 20-year and 30-year annualised rates of return for the ADIA portfolio were 5.4% and 6.5% respectively, as of 31 December 2018.

Performance is measured based on underlying audited financial data and calculated on a time-weighted basis.

Note: Performance for 2018 remains provisional until final data for non-listed assets is included

- 20 YRS (P.A.)

- 30 YRS (P.A.)

- 20 YRS (P.A.)

- 30 YRS (P.A.)

Operational Review

At ADIA, we believe the business of investing is undergoing a significant transformation. During 2018, ADIA continued to apply a coordinated, proactive and forward-looking approach to strategic and organisational change.

Read the Operational Review2018 Highlights

- A more structured approach to gaining actionable insights

- Enhancing organisational agility to respond to emerging opportunities

Investment Review

ADIA manages a global investment portfolio that is diversified across more than two dozen asset classes and sub-categories. ADIA’s investment departments are responsible for building and managing investment portfolios within the parameters set for them through the asset allocation process. These investment departments, which invest across multiple geographies, have discretion over the origination and recommendation of investment proposals.

For more detail on each of ADIA’s major asset classes in 2018, please select the relevant section.

Equities

Volatility returned to global equities in 2018, with markets swinging sharply at several key points during the year. Heading into 2019, valuations were at levels that some would consider attractive relative to expected earnings.

Read moreFixed Income

After the relative calm of 2017, fixed income investors were confronted with a more complex constellation of factors to manage in 2018, most notably a return to monetary normalisation after an unprecedented decade of ultra-loose policy.

Read moreAlternatives

Financial markets faced a more challenging environment in 2018 than the year before, as resurgent concerns about global growth triggered volatility and damped returns.

Read moreReal Estate

The global real estate market recorded its ninth consecutive year of growth, albeit amid signs of slowing momentum as the cycle continued to mature.

Read morePrivate Equity

The private equity market enjoyed another record-breaking year in 2018, with fundraising and deal activity maintaining a robust pace even as valuations topped all-time highs.

Read moreInfrastructure

Demand for infrastructure assets scaled new heights in 2018, as investors continued to seek out the asset class for its diversification characteristics and reputation for relatively stable returns.

Read moreBoard of Directors and Investment Committee

Management of ADIA is vested in ADIA’s Board of Directors, which comprises a Chairman, Deputy Chairman, Managing Director and Board Members who are appointed by a decree of the Ruler of the Emirate of Abu Dhabi.

The Investment Committee assists the Managing Director and is responsible for managing and overseeing investment-related matters. The Managing Director chairs the Investment Committee, assisted by two Deputy Chairmen, with the participation of the Executive Directors of all investment departments and representatives of some control functions as required.

Long-Term Investment Trends

ADIA maintains a focus on the major themes and issues shaping financial markets over the long term. We view this as central to our ability to fulfil ADIA’s mission, which is inherently long term in nature. Our people are encouraged to devote time to analysing the forces that will define the global economy of the future.

In this section we ask a selection of ADIA investment professionals to identify just some of the ways that their asset classes might be impacted by two major trends over the next decade: technology and climate change.

Technology

The business of investing has been transformed by rapid advances in technology over recent years. In the articles below, we explore how the next phase of technological development might affect markets, private equity investing and the real estate sector.

Read moreClimate Change

As financial markets continue to respond to policy changes and advances in climate change technology, we look at some of the opportunities and risks for investors brought about by the transition to a lower carbon global economy.

Read moreDisclaimer

The contents of this review are provided by ADIA for information purposes only and, therefore, should not be construed as investment advice or a recommendation to buy or sell any investment instrument.

No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information contained in this review by ADIA.

ADIA accepts no liability for any losses or damages incurred or suffered that are claimed to result from the use of or reliance upon any information contained in this review including, without limitation, any direct, indirect, incidental, special or consequential damages. Any statements or terms in this review used to describe ADIA’s relationship with third parties does not, and should not be construed to, acknowledge or establish any legal relationship between ADIA and such third party, acknowledge or establish any fiduciary duty on the part of ADIA to such third party or otherwise, or acknowledge or establish any responsibility for or liability in respect of the actions of such third parties.

The copyright to this review is held by ADIA.

Unauthorised reproduction or conversion is strictly prohibited.