Letter from Hamed bin Zayed Al Nahyan

With a long‑term mandate to generate returns for future generations, ADIA’s inherent preference is to view market performance in any given year within a broader context, to gain a more nuanced picture of overall trends. On this basis, 2018 provided ample reassurance despite challenging conditions.

While most equity and fixed income markets ended the year lower, 2018 marked a decade since the onset of the global financial crisis, a period during which investors have benefitted from largely uninterrupted wealth creation.

By the end of 2018, global equities had recorded an annualised return of 10% over the previous 10 years, with real returns benefitting from the backdrop of historically low inflation. Private assets, such as real estate, private equity and infrastructure, have also surged to near record levels, aided by the widespread availability of low‑cost funding stemming from years of accommodative monetary policy.

Bond returns have recorded less impressive growth during this period. However, with yields hovering near zero, that should come as no surprise.

The economic expansion over the past decade is one of the longest on record, and this remained generally intact last year even as markets paused for breath before recovering their losses and more in the early months of 2019.

Economies did slow last year, but the overall result was still an above‑trend rate of economic expansion.

A slowdown in China received much attention, but to date the reality does not appear to have matched the degree of concern. European growth did weaken materially, but there was no evidence of any major turn in the cycle. While some emerging market countries experienced recession, this did not spread more broadly to other markets. India, Russia, and to a lesser extent, Brazil, were relatively resilient in 2018.

The U.S. economy grew faster than in 2017, buoyed by a fiscal policy boost from tax cuts and spending increases. Outperformance of the U.S. economy and equity markets in 2018 was one of the most important outcomes of the year, although it is unlikely that the relative performance gap will be permanent. In a still closely integrated global economy, divergences of this kind more often ebb and flow than persist indefinitely.

One of the noteworthy events of last year was a broad and regrettable deterioration in trade relations. This included both increases in tariffs and greater resistance to cross border flows of both capital and labour. This was not typical volatility; rather it appeared more as an inflection point in the process of globalisation that has been a tail wind for economies and markets over the past several decades.

The myriad potential outcomes of a less hospitable international economic system will result in new challenges – but also ample opportunities – for global long‑term investors.

In 2018, as throughout our history, ADIA continued to deliver on its mission of prudently managing capital on behalf of the Government of Abu Dhabi. By building a highly diversified portfolio, spread across asset classes and regions, ADIA has been able to withstand the ups and downs of markets over many years to produce sustainable, long‑term returns for the benefit of Abu Dhabi.

In 2018, ADIA’s 20‑year and 30‑year annualised rates of return were 5.4% and 6.5% respectively. While these rolling averages were impacted somewhat by the exclusion of strong gains in the mid‑to‑late 1980s and 1990s, ADIA’s real returns remained largely consistent with previous years and historical levels. For global investors, the past decade can be viewed as a qualified success story. Faced with a challenge of historical proportions, policymakers in different countries worked together to restore the global economy to a stable footing, leading to a decade of near uninterrupted wealth creation.

The world economy may not be strong, and valuations of many assets are now at cyclical highs, but the financial system is more robust than it was 10 years ago.

-

Portfolio

Portfolio overview

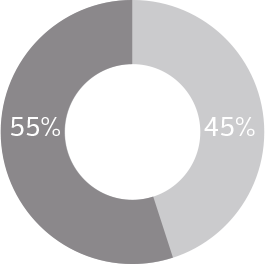

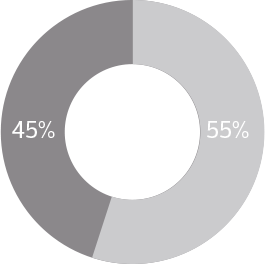

ACTIVE VERSUS PASSIVE MANAGEMENT ActivePassiveINTERNAL VERSUS EXTERNAL MANAGEMENT

ActivePassiveINTERNAL VERSUS EXTERNAL MANAGEMENT InternalExternal

InternalExternal- Minimum

- Maximum

-

Regions

Long-term policy portfolio by region

*ADIA, as a matter of practice, does not invest in the UAE.

Long-term policy portfolio by region

NORTH35% MIN

50% MAX

EUROPE20% MIN

35% MAX

EMERGING15% MIN

25% MAX

DEVELOPED10% MIN

20% MAX

*ADIA, as a matter of practice, does not invest in the UAE. -

Annualised Returns

Annualised rates of return

In U.S. Dollar terms, the 20-year and 30-year annualised rates of return for the ADIA portfolio were 5.4% and 6.5% respectively, as of 31 December 2018.

Performance is measured based on underlying audited financial data and calculated on a time-weighted basis.

Note: Performance for 2018 remains provisional until final data for non-listed assets is included

- 20 YRS (P.A.)

- 30 YRS (P.A.)

- 20 YRS (P.A.)

- 30 YRS (P.A.)

Outlook

Looking ahead is always an exercise in managing uncertainty, and accepting that the unexpected will likely happen. At ADIA, our primary goal is to develop a broad picture of long‑term opportunities and risks so that we remain optimally positioned to manage them.

The state of the business and financial cycle has received increased attention as the last downturn recedes into the past. We understand that economies have recessions and that markets have drawdowns. What is less certain is their respective timing. While “late‑cycle” has become a common term in market outlooks for 2019, we believe that the diversity and adaptability of economies means that the current cycle may well surprise with its resilience.

Most of our thinking about the future goes beyond cyclical forces to seek to uncover important secular themes. Of these, one that concerns us most is the possible retrenchment of globalisation. Increasing freedom of movement of goods, capital and people across borders has been a dominant tailwind boosting economic growth and asset prices over the past several decades. It is clear that the gains from trade have not always been shared equally within and across countries, and that forces of nationalism have gained traction at the expense of economic liberalism. It is incumbent on participants in capital markets, who see the benefits of globalisation first hand, to present the positive case and ensure that the public debate is well informed.

A more positive trend is the growing attention to ESG (Environmental, Social, Governance) factors in asset management, which is encouraging capital allocation to investments with positive societal, and not just financial, impact. While investors – including ADIA – have long been concerned with these issues, progress is now being made in developing quantitative metrics to measure companies’ performance in line with ESG factors. We welcome the greater transparency around these issues.

One way that ADIA has played a role in this process has been through its founding membership of the One Planet Sovereign Wealth Fund Group. In 2018, the Group developed a framework to assist funds with long‑term investment strategies in integrating climate change analysis into their investment processes. Finally, trends in technology remain an essential element of our thinking about the future. Progress is definitely accelerating, and few industries are likely to remain untouched by advances already underway or at the cusp of reaching commercial viability. The potential for these innovations to boost productivity and economic wealth is substantial, and offers an important counterpoint to the pervasive “growth pessimism” that is gaining traction among investors.

Beyond these impacts on economies, it has become obvious how technology is affecting our own investment industry. We believe the effective use of new tools for gathering and interpreting data will be a key source of competitive advantage that will allow active management to succeed. Like other investors, ADIA has been testing data processing systems to increase efficiency and extract meaningful insights.

Looking ahead, it appears likely that global growth will remain stable for the foreseeable future, although contributions will be spread unequally between countries. Demographic trends continue to favour emerging over developed economies, with India and China in particular expected to remain important engines of growth. We will continue to seek opportunities to invest in these higher growth markets, most typically alongside local partners in sectors that are closely aligned with the growth priorities of their respective governments. The world will continue to change, often in unexpected ways. As in the past, ADIA’s investment approach will prioritise diversification, to ensure it continues to generate steady risk‑adjusted returns over time. In what is an increasingly complex and fast‑moving world, our success will also be determined by our ability to prudently innovate and evolve on a continuous basis, so that we are able to respond quickly and with confidence to capture opportunities when they emerge.

I look forward to the future with quiet confidence in ADIA’s ability to draw on the lessons of the past while embracing the opportunities and realities of the future.

Together, these traits will ensure that we continue to deliver successfully on our mission.