ADIA’s mission is to sustain the long-term prosperity of Abu Dhabi by prudently growing capital through a disciplined investment process and committed people who reflect ADIA’s cultural values.

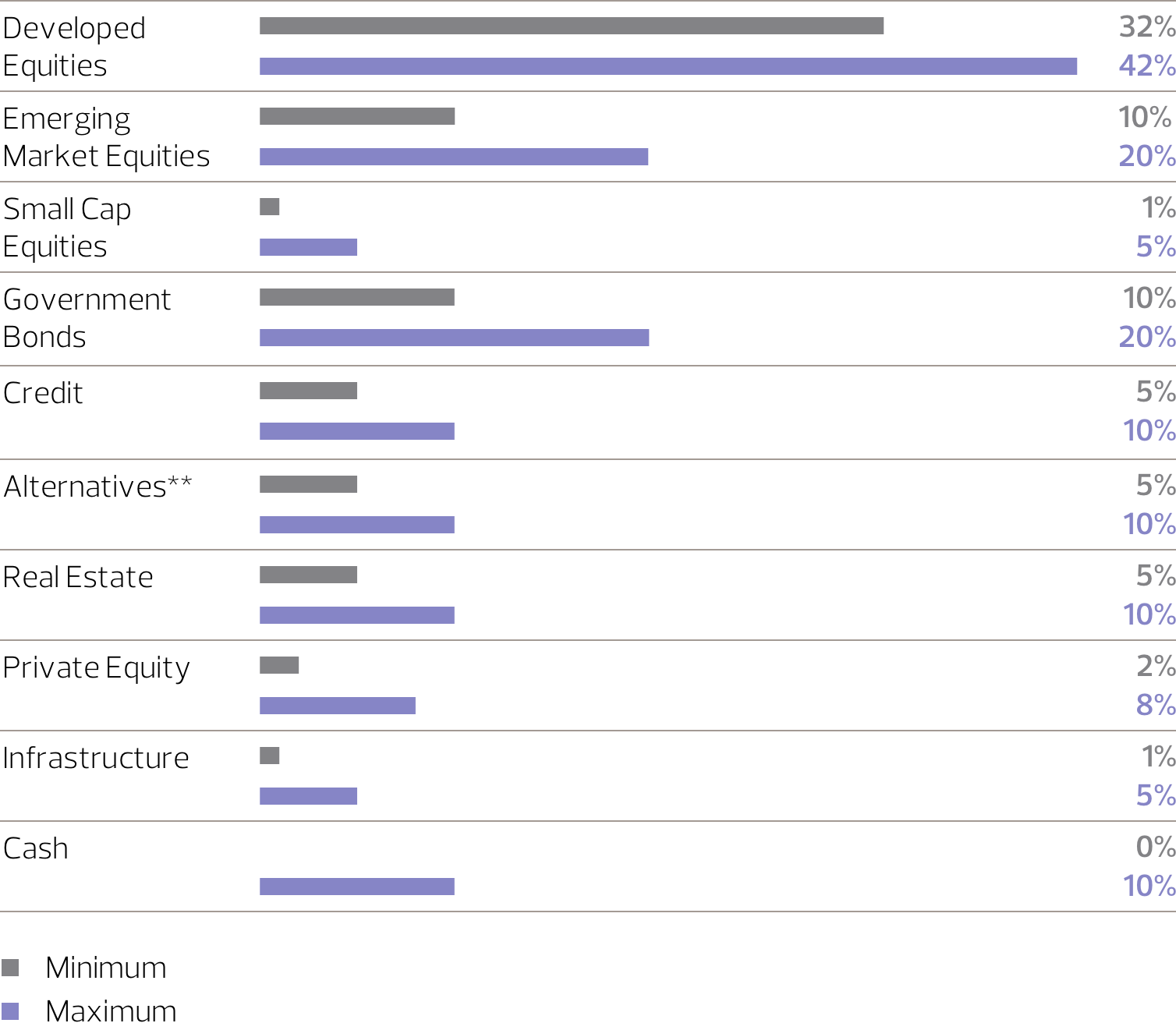

ADIA manages a global investment portfolio that is diversified across more than two dozen asset classes and sub-categories.

With a long tradition of prudent investing, ADIA’s decisions are based solely on its economic objectives of delivering sustained long-term financial returns.

Our three cultural values guide the way we work

ADIA’s cultural values guide the way we work and the way decisions are made. They provide direction for how we think and behave as individuals and as a unified institution.

These values play a fundamental role in driving our people and the organisation forward to achieve long-term growth and business success.

1,750 employees covering more than 60 nationalities

ADIA’s people are as diverse and international as our business, with more than 60 nationalities working together to create a collaborative environment that embodies our cultural values.

We strive to attract, develop and retain world-class talent, and to enable our people to realise their full potential.

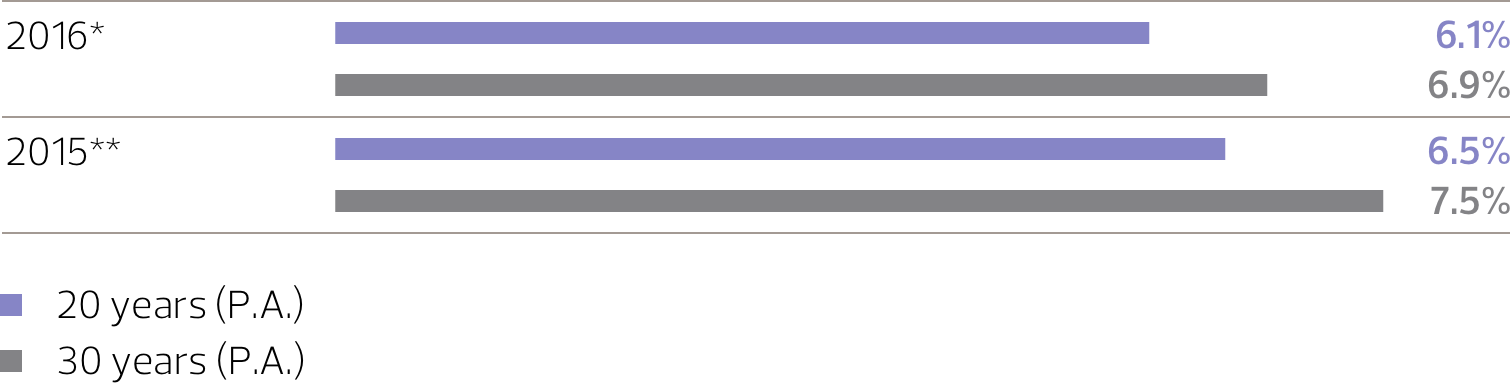

In U.S. dollar terms, the 20-year and 30-year annualised rates of return for the ADIA portfolio were 6.1% and 6.9% respectively, as of 31 December 2016. Performance is measured based on underlying audited financial data and calculated on a time-weighted basis.

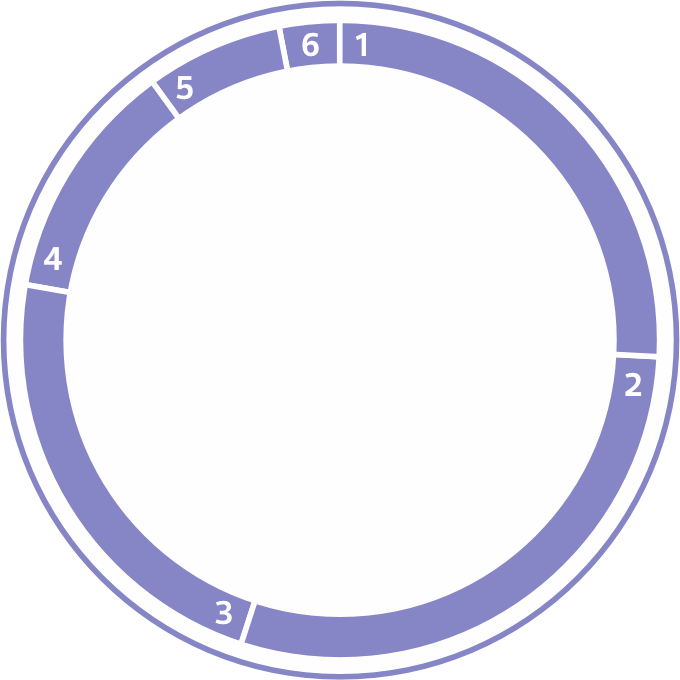

of ADIA’s assets are managed by external fund managers whose activities are subject to careful oversight by internal ADIA teams.

of ADIA’s assets are invested in index- replicating strategies.

ADIA’s cultural values guide the way we work and the way decisions are made, and they are central to sustaining our investment success. They provide direction for how we think and behave as individuals and as a unified institution. It has been over a decade since our cultural values of effective collaboration, prudent innovation and disciplined execution were formulated and embedded throughout the organisation.

The three ADIA cultural values that we encourage employees to demonstrate are:

Prudent

Innovation

ADIA’s

Mission

Disciplined

Execution

Effective

Collaboration

Our goal is to attract, develop and retain world-class talent and provide the resources for our people to realise their full potential.

ADIA’s people are as diverse and international as our business, with more than 60 nationalities working together to create a collaborative environment that embodies our cultural values.

ADIA employees by nationality

In many ways, ADIA has changed beyond recognition since its humble beginnings 40 years ago. However, in what has become a lasting tribute to the vision of ADIA’s founders, there are numerous enduring characteristics of the organisation that were embedded in its earliest days and still remain firmly in place today. Together, these have made a significant contribution to ADIA’s success over the years and form an integral part of our shared identity.

To mark our 40th anniversary, we brought together a cross-section of employees and asked them a few questions about ADIA’s core characteristics and how they are reflected across the organisation today.

Heather - As a member of the HR team, I always try to remind myself that what I do every day impacts the ADIA mission, which is of course very long-term focused.

This starts right at the beginning, with how we recruit. Any company will look at whether the individual has the right capabilities and technical competencies, but at ADIA it's extremely important that we select someone

who will be collaborative, who is going to be focused and execute in a disciplined way and come up with those innovative ideas that will take ADIA into the future.

Marcus - From an investment perspective, when we invest in an infrastructure asset we assume we are going to hold it for 20, 30 years or longer. We won't always ultimately invest for that long but we are thinking

about the risks and drivers of value over a long period of time. There is a maturity and level of experience that means people don't get that excited by quick wins or too disappointed when things don't go immediately to plan.

It also means we are very conscious of matters like reputation and relationships.

Of course, being a long-term investor doesn't mean you can be complacent. It's essential to keep a keen view on risk and value so that

we are well informed and able to move quickly if there is an opportunity or a need to respond to changing market dynamics.

Matar - Having a long-term focus, and a well-structured portfolio, is a competitive advantage. It means that ADIA has been able to weather market downturns and avoid liquidation pressures. But there is also a

human aspect to it. As an organisation, we don't tend to react immediately to cycles to make decisions about the size of our workforce. The focus is on creating and developing the culture through our people and trying to maintain

the same culture over the long term, whether that's to support investments or to develop leaders.

Having a strong culture is a big factor in how you retain people.

Reem - That's an important point. Even our individual development plans here look several years into the future. I have been working at ADIA for more than nine years and there has always been a long-term plan

for me, which I have been involved in developing.

For the last four years I have been in the Internal Audit Department, which is all about long-term thinking and trying to ensure ADIA achieves its goals for the good of Abu Dhabi. In my team, we use advanced data analytics

techniques which are the future in many business areas. We are always encouraged by management to think of the bigger picture and what the end result will look like in the long term.

Reem - For me, it is a fantastic opportunity to learn from some of the best talent in the world. I also believe that this opportunity has increased the cultural awareness across ADIA. Being exposed to such a diverse workforce means that I am more confident in how I interact and communicate during external business meetings and missions.

Matar - ADIA's diverse workforce is a reflection of its diverse portfolio. What's really impressive, though, is that you would think that one culture might dominate others, but ADIA has created its own culture. There is a common purpose where employees work and collaborate to achieve a shared goal. It is such a respectful environment where people tend to get along and focus on getting things done. Personally, one of the great benefits is being exposed to a diverse pool of talents.

Marcus -There is a cultural element but there is also a practical element. For example, when we want to look at an investment opportunity in India or South America we have people who know the region, can speak

the language and understand local dynamics. Certainly for what we do there is a significant practical benefit to having people from different backgrounds.

In our team, everyone, irrespective of their position, is encouraged to share their view, and the most valuable views are the ones that are different to the consensus. So if someone has the courage to share an alternative

view, that is always respected and valued.

Matar - That is how we actually generate returns – with insights that are different from others.

Heather – All the research shows that getting buy-in is very important to any decision – you need to engage people and achieve consensus, otherwise you will fail. So ADIA's culture very much follows suit when it comes to that. If there is an important decision that needs to be made in this organisation it goes through the proper level of stakeholder engagement involving multiple teams and going through the committee structure. What this means is that by the time a decision is made, not only is it the right decision, but you have a level of buy-in that you wouldn't have had otherwise, so I think it works very well.

Marcus – I would also add that seeking consensus doesn't mean you can't move fast when you need to. Important decisions here can often be made very quickly. Our partners are often surprised how often our Investment Committee meets and how quickly we can get things approved, and certainly when we look at our peers around the world that's not always the case.

Matar – At ADIA, it's not a one-man show. It's about calibrating everything back to the objectives of the portfolio. Our mission is to preserve capital for the next generations and grow it. It's true that we have consensus at the end but the road to consensus is not always an easy one. Sometimes people can have strongly opposing positions and they don't always converge to the middle, and that's how we should think about it – as a weighted wisdom decision from everyone, so you are not concentrated to one view. Every decision made represents a collective view that is carefully and thoroughly vetted, after considering different perspectives.

Reem - My first job after graduating from college was at ADIA, and I am grateful for all the opportunities I have had since joining here.

It's certainly true that ADIA focuses a lot on training, and it's not only technical training but also personal development courses. I have obtained the ACDA – ACL Certified Data Analyst Certification – and was the first

UAE National to do so.

I also recently completed the Professional Development Programme (PDP), which helps participants to develop skills and capabilities that improve individual performance and build the future of the organisation.

Matar - My former manager once said to me: "If you want return, you have to invest." At first, I thought that he was talking about investing in assets, but he was actually referring to talent development. That

is ADIA's most valuable asset. There is always an opportunity to develop your skills here. When I joined ADIA back in 2011 as a fresh graduate the first thing I did was enrol into the CFA programme, which I then successfully

completed.

My development has never stopped since then. I've had the opportunity to attend many different courses and seminars, but I have probably learned the most from the experiences I get through my day-to-day work.

Marcus - From an investment perspective, the number and diversity of opportunities you get here to review and consider and learn from is invaluable. It rapidly develops your experience, decision-making and judgement.

On the more traditional training side, ADIA has supported me and proactively identified courses that are relevant to me, in areas as diverse as director training or even how to manage sea ports.

There is a culture here that no matter how junior or senior you might be, you can always improve your skills and experience.

Heather - I love the fact that you don't have to travel, you don't even need to leave the building – you have extremely engaging speakers, renowned speakers that come in and are helping to educate us as a workforce.

It's expected that we take advantage of some of these learning opportunities to grow our collective skillset, so it's not as if you feel guilty taking some time out of work – it's part of the culture, it's part of the

job that you need to develop your skills.

Matar - It's true that this doesn't feel like an ordinary job. I have always felt the need to give something back, because I have been given an opportunity but also because of the important role that ADIA plays for Abu Dhabi.

Reem - As a UAE National, working for ADIA carries with it a sense of responsibility towards my country and the welfare of the future generation.

Every decision made in ADIA today will have an impact on my family and society in the future. Is responsibility is a great motivation for me to work hard in my day-to-day job.

I feel a real sense of excitement and eagerness to learn.

Marcus - When they think about taking a job here, most expats would think about the experience and the opportunity and that's valid. But I think having worked here for a period of time you do pick up that sense of responsibility. From time to time it's quite humbling to recognise how important the organisation is to the people and to the Emirate. So it does have a different dynamic to working in a financial institution elsewhere.

Heather - It's unique to ADIA that you have a large population that are so committed to the mission and I think it plays a large role in driving people's loyalty. I also think that has an impact on how people from other cultures feel about their jobs here. It's contagious. It creates a sense of purpose and connectedness to the organisation. Our retention is extremely high.

Marcus - I wouldn't have a job here if ADIA wasn't willing to adapt and embrace change, because building a team to focus on direct infrastructure investments ten years ago was a big call to make.

Since then, what has impressed me is how decisive and supportive ADIA has been to doing new things, such as growing in markets like India and China, where there are many issues and risks to consider. There is a recognition of the rapidly increasing importance of these markets and of the need to build our understanding, experience and relationships now.

Heather -We have run an opinion survey here for the past five to six years and we have used that to help identify areas where we can grow and improve as an organisation.

People are thinking about what is going to happen in the future and how we can innovate, so that we can anticipate and react to changes in the environment.

This is an area where we need to continue to work, but it's one where we have made definite progress in the past few years.

One example is our senior leadership forum, which brings together all our senior management every quarter to discuss ways of improving the organisation.

Matar -Being around for 40 plus years and having achieved everything that it has, is proof that ADIA can adapt. There is a real emphasis on innovation and the management is always open to improvements in the investment process, or in how we organise ourselves.

The size of ADIA requires moving at a certain pace. Moving faster or slower creates risks. That's why continuous improvement that is logical and clearly understood is much better than big, dramatic changes that might be disruptive and not have everyone's full support.

“We have a culture of debating ideas here, and with the different perspectives we have around the table those conversations are often lively, but always respectful and always open.”

“One of the things that I noticed immediately after joining ADIA was the level of access we have to some of the world’s very best investors.”

An early ADIA Board meeting, chaired by His Highness Sheikh Khalifa bin Zayed Al Nahyan.

ADIA was created in March 1976 by an Emiri decree from the late Sheikh Zayed bin Sultan Al Nahyan, Ruler of Abu Dhabi and founding President of the United Arab Emirates.Established as an independent investment institution, ADIA was given a clear mission to prudently grow capital in order to secure the long‑term prosperity of Abu Dhabi.

ADIA replaced an earlier institution, the Abu Dhabi Investment Board, which had been formed in 1967 to oversee the activities of London‑based external fund managers who were tasked with investing the budget surpluses from Abu Dhabi’s recently-commenced oil production into global markets.

The creation of ADIA was a landmark moment when Abu Dhabi assumed direct control of managing its own wealth, and began creating the practices and processes that would allow the organisation to grow and develop.

In addition to its primary role of safeguarding the Emirate’s wealth, ADIA also played a key role as a training ground for some of Abu Dhabi’s brightest talents, many of whom later used their skills to play important roles in government and the private sector.

From its earliest days, ADIA’s clarity of mission, independence, and commitment to investing in and nurturing human capital, were critical in ensuring the success of the organisation in the years to come.

ADIA’s first purpose-built headquarters, which it occupied from 1985 to 2007.

During the 1980s, as its assets grew, ADIA continued to develop, diversify and grow into a truly global investment institution.Based in its first official headquarters at 125 Corniche Street in Abu Dhabi, ADIA was initially organised into four departments: Bonds and Equity, Real Estate, Finance and Administration, and Local and Arab Investments.

The majority of assets were held by the Bonds and Equity Department, but as the fund grew ADIA began a process of rapid diversification and increasing sophistication.

ADIA was an early adopter of alternative investment strategies, allocating a portion of its capital in 1986 to hedge funds, which many at the time still considered an emerging asset class. In a further sign of its willingness to embrace change after prudent consideration, ADIA added private equity to its asset mix in 1989, prior to the eventual creation of the global Private Equities Department in 1997.

The institution took a further step forward in the early 1990s with the creation of the Evaluation and Follow-Up Department, which added an extra layer of rigour and analysis to the investment process, and resulted in the introduction of formal asset allocation across the portfolio.

In 1997 two of ADIA’s founding fathers, Deputy Chairman Ahmed Khalifa Al Suwaidi and Managing Director Mohammed Habroush, both integral to the organisation’s evolution and development since its formation, handed over leadership of the institution to the late Sheikh Ahmed bin Zayed Al Nahyan, who became Managing Director. Sheikh Ahmed went on to lead ADIA through a significant phase of growth and is recognised as an influential architect of ADIA’s ongoing success.

ADIA’s Investment Committee in 2009.

ADIA entered the 2000s during a period of high growth and diversification into new markets, and the introduction of new asset classes with greater levels of complexity.This required internal functions and governance structures to develop to keep pace with the demands of an increasingly sophisticated institution. This process of evolution and specialisation continues today.

In the mid-2000s, important changes were made to how ADIA recruited, managed and rewarded its employees. This work, undertaken over the course of several years, had a profound impact on almost every aspect of how ADIA organised itself and how its employees worked together.

In 2007 ADIA moved into its current headquarters at 211 Corniche Street, Abu Dhabi. That year also saw the introduction of infrastructure as an asset class, while the following year both the Internal Equities Department and Strategy Unit were created.

In 2008, as Co-Chair of the International Working Group of Sovereign Wealth Funds alongside the IMF, ADIA played an important role in the design and development of the Santiago Principles for SWFs. These principles and practices play an important role in building trust between SWFs and host countries by making clear that signatories are investing solely for financial returns. They also provide newer funds with an operating model that supports their efforts to achieve best practice.

Today, ADIA employs 1,750 people representing more than 60 nationalities at its headquarters in Abu Dhabi.

Sheikh Hamed bin Zayed Al Nahyan became ADIA’s Managing Director in 2010, and has continued to build on the traditions established by the institution’s founding fathers, while innovating and expanding into new areas and activities.As ADIA has continued to evolve, so has its organisational structure. Between 2011 and 2013, the External Equities, Indexed Funds, Human Resources, and Central Dealing departments were all created, and infrastructure was combined with real estate into a new Real Estate and Infrastructure Department.

As an organisation that encourages questioning the status quo, this process of organisational optimisation continues today.

In 2014, the inaugural Global Investment Forum was held to stimulate the cross-departmental sharing of insights and experience. The event is held annually and tackles major issues that are shaping global financial markets now and into the future.

Today, through continuous engagement and backed by a long and successful track record, ADIA continues to emphasise building strong and trusted relationships with governments, regulators and business partners around the world.

ADIA’s reputation is built on clarity and consistency – it is evident in behaviour and decisions that closely align with its mission of safeguarding and growing wealth for future generations. In keeping with its prudent nature, ADIA backs this up with high standards of governance, and clearly defined roles in the organisation that ensure responsibility and accountability.